Advantages of Equipment Leasing and Equipment Financing

Quick Equipment Leasing & Small Business Financing

Nearly every business needs quality equipment to function efficiently and serve their customers. Amerifund Inc. proudly helps countless nationwide commercial clients with advantages of equipment Leasing and equipment financing, including small businesses in the Dallas-Fort Worth, TX area. Unfortunately, commercial loans from banks involve a significant amount of time and stress with extensive paperwork, business plans, and other details. You may also endure long processing times while the bank considers your approval and releases funds for your commercial needs. Amerifund’s leasing and financing adds the equipment you want quickly and pays for it with and with little or no paperwork. Our services provide quick approvals and fundings, with some same-day fundings available.

Generate Revenue as You Pay

Start using your new equipment and watch your revenue increase. You’ll generate revenue sometimes before your first payment is due.

Improves Cash Flow

A positive cash flow allows you to make good investment decisions, giving your business a leading edge while providing financial stability.

100% Tax Deductible*

Financing your equipment is 100% tax deductible up to $1,050,000. Section 179 allows your business to deduct 100% of the cost of the business equipment within the year that it is purchased.

Low, Affordable Payments

You choose the payment terms, ranging from 24-60 months to best fit your business, budget. Ask about our 90-day deferrals and seasonal payments.

Generate Revenue as You Pay

Start using your new equipment and watch your revenue increase. You’ll generate revenue sometimes before your first payment is due.

Improves Cash Flow

A positive cash flow allows you to make good investment decisions, giving your business a leading edge while providing financial stability.

100% Tax Deductible*

Financing your equipment is 100% tax deductible up to $1,050,000. Section 179 allows your business to deduct 100% of the cost of the business equipment within the year that it is purchased.

Low, Affordable Payments

You choose the payment terms, ranging from 24-60 months to best fit your business, budget. Ask about our 90-day deferrals and seasonal payments.

Understanding Equipment Leasing Benefits vs. Bank Loans

Customers choose Amerifund business financing and equipment leasing options for many reasons. Getting a commercial bank loan places the “rate risk” on your shoulders, starting with a lengthy application process, often with long-term money coming at a floating or variable rate. Many bank loans require a 20% plus upfront payment, and you may need to pledge your assets as collateral. If you default on your loan payments, the bank can seize those assets. The benefits of leasing equipment over getting a bank loan make our services an appealing alternative. Some of these benefits include the following:

- A lease has a fixed rate payment ideal for budgeting.

- You rarely have a 20% plus down payment to secure a lease.

- You choose to own the equipment, extend your lease, or return the equipment at the end of a lease.

- The finance company assumes the outdated or obsolete equipment risks, letting you upgrade and return it when your lease ends.

- The equipment you lease serves as your collateral if you miss payments.

- Lease payments are almost always 100% deductible, or you may use them as a form of accelerated depreciation.

- Some leases have 90-day deferrals available

Our easy and secure online application takes less than two minutes

Once approved – you choose your terms

You sign your documents and send them back

Your equipment is paid for and your equipment ships to you

Start generating income and watch your profit increase

Our easy and secure online application takes less than two minutes

Once approved – you choose your terms

You sign your documents and send them backs

Your equipment is paid for and your equipment ships to you

Start generating income and watch your profits increase

Why It’s Better to Lease Than Buy Equipment

Leasing or financing equipment instead of buying it comes with a collection of advantages for businesses. Many commercial customers desire the benefits of the Section 179 tax deduction. General equipment ownership may be appealing, but getting a bank loan typically includes high initial costs, like a 20% down payment and additional fees. After the loan term, you own the older equipment if you buy it. Unfortunately, what once was an advanced piece of equipment may be obsolete within a short time, and its resale value may be significantly less than what you paid.

While leasing equipment means you don’t own it (during your lease term), you get the benefits like a lower initial expense, more flexible lease terms than bank loans typically offer, and its tax deductions reducing your lease’s net cost. Check out the benefits of the Section 179 tax deduction. If you lease, the lessor takes on the burden of obsolescence with high-tech equipment like computers and other specialized devices. With leasing, you can lease newer, advanced equipment once your lease expires.

What’s the Difference Between Loans & Financing?

Amerifund realizes many businesses don’t understand the difference between loans and financing, so choosing the right one for your commercial needs can be difficult. Your account manager will help you decipher whether a loan or finance works best for your business. In some instances, a business desires to own the equipment at the end of its lease term. If you choose a $1 buyout at the end of the lease, you will own your equipment outright.

Funding is Quick & Easy

Two minute application, get approved in hours, fund shortly after

100%+ Financing

Minimize your out of pocket cost expenses

Tailored Payments

Ask about special seasonal payments or deferred payments

Tax Advantages

Get your equipment now and write off 100% of its cost this year

No Bank Restrictions

No liens, rate escalation clauses, or “call” provisions

Lowest Rates Available

Funding for established, new businesses and challenged credits

Funding is Quick & Easy

Two minute application, get approved in hours, fund shortly after

100%+ Financing

Minimize your out of pocket cost expenses

Tailored Payments

Ask about special seasonal payments or deferred payments

Tax Advantages

Get your equipment now and write off 100% of its cost this year

No Bank Restrictions

No liens, rate escalation clauses, or “call” provisions

Lowest Rates Available

Funding for established, new businesses and challenged credits

Businesses Nationwide Rely on Amerifund Inc.

When your business needs equipment to manage it professional activities, Amerifund Inc. is ready to help. Our nationwide leasing and financing include cities and towns throughout the country, including Phoenix, AZ and Dallas and Fort Worth, TX. Your business deserves the best quality equipment to stay competitive, and we offer our small business financing and equipment leasing services to help you grow and prosper. Contact us today to learn how we can help you stay on top of the latest equipment and start our easy, two-minute application process with quick approvals and competitive rates.

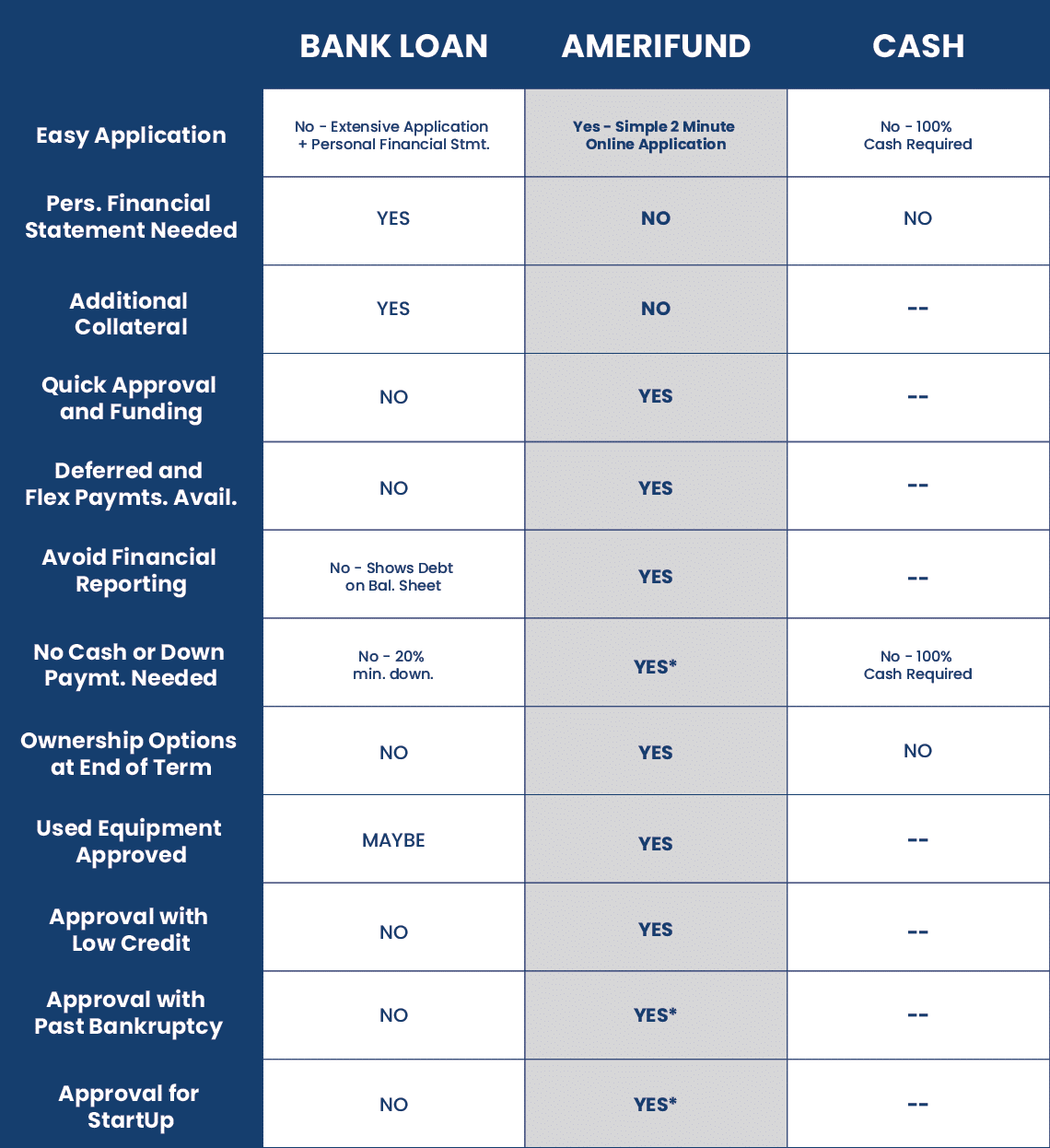

Easy Application

Bank Loan: No – Extensive Application

+ Personal Financial Stmt.

Amerifund: Yes

Simple 2 Minute Online Application

Cash: No – 100% Cash Required

Pers. Financial Statement Needed

Bank Loan: Yes

Amerifund: No

Cash: No

Additional Collateral

Bank Loan: Yes

Amerifund: No

Cash: —

Quick Approval and Funding

Bank Loan: No

Amerifund: Yes

Cash: —

Deferred and Flex Paymts. Avail.

Bank Loan: No

Amerifund: Yes

Cash: —

Avoid Financial Reporting

Bank Loan: No – Shows Debt on Bal. Sheet

Amerifund: Yes

Cash: —

No Cash or Down Paymt. Needed

Bank Loan: No – 20% Min. Down

Amerifund: Yes*

Cash: No – 100% Cash Req.

Ownership Options at End of Term

Bank Loan: No

Amerifund: Yes

Cash: No

Used Equipment Approved

Bank Loan: Maybe

Amerifund: Yes

Cash: —

Approval with Low Credit

Bank Loan: No

Amerifund: Yes

Cash: —

Approval with Past Bankruptcy

Bank Loan: No

Amerifund: Yes*

Cash: —

Approval for StartUp

Bank Loan: No

Amerifund: Yes*

Cash: —

*On Approved Credit

*On Approved Credit

Legal Disclaimer: Amerifund Inc. does not represent nor are we associated with American Funds | Capital Group